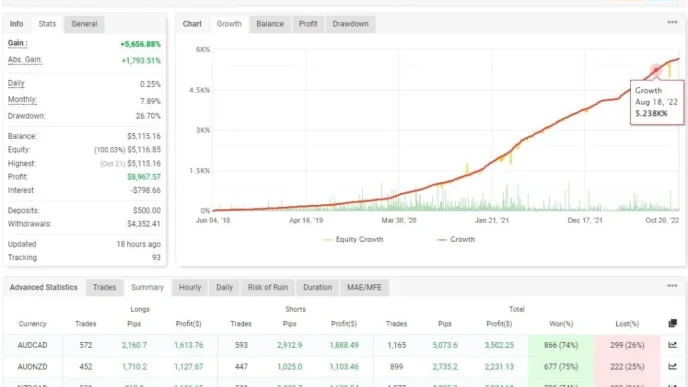

The TrendMaster FX EA is a fully automated Forex trading robot that claims to leverage advanced algorithms and deep learning technology to enhance trading performance. While its developers present the EA in glowing terms, it’s essential to critically examine these claims to determine if TrendMaster FX EA truly delivers innovative trading solutions or if it leans heavily on marketing.

According to its creators, TrendMaster FX EA uses deep learning to analyze nearly a decade’s worth of historical market data, aiming to refine decision-making and adapt effectively to market trends.

Key Features and Strategy of TrendMaster FX EA

- Focus on Significant Market Movements: Unlike high-frequency scalping strategies, TrendMaster FX EA targets substantial market swings, often in the range of several hundred to a thousand points. This approach suggests traders can maintain relatively low lot sizes, reducing risk exposure while capturing larger market movements.

- Risk Management Through Stop Loss and Hedging: The EA avoids high-risk strategies like grid or martingale systems. Instead, it assigns a stop loss for every trade and offers hedging as a form of protection during major market shifts, helping to minimize account risks.

- Trend Judgment System: Recently, the EA’s developers introduced a trend judgment system to enhance trade accuracy. This system filters out trades that counter the prevailing market trend, potentially improving the quality of trades at the expense of fewer trade opportunities.

Skepticism and Caution

Despite these features, there’s skepticism about the EA’s actual use of deep learning. True deep learning requires significant computational resources and complex algorithmic designs, and in the Forex EA industry, terms like “advanced algorithms” and “deep learning” are often used for marketing appeal rather than as accurate descriptions of the technology in use.

Prospective users should approach these claims with caution. While the EA includes intriguing features, the depth and effectiveness of its deep learning capabilities are unclear without transparent details about its underlying technology.

Recommendations for Using TrendMaster FX EA

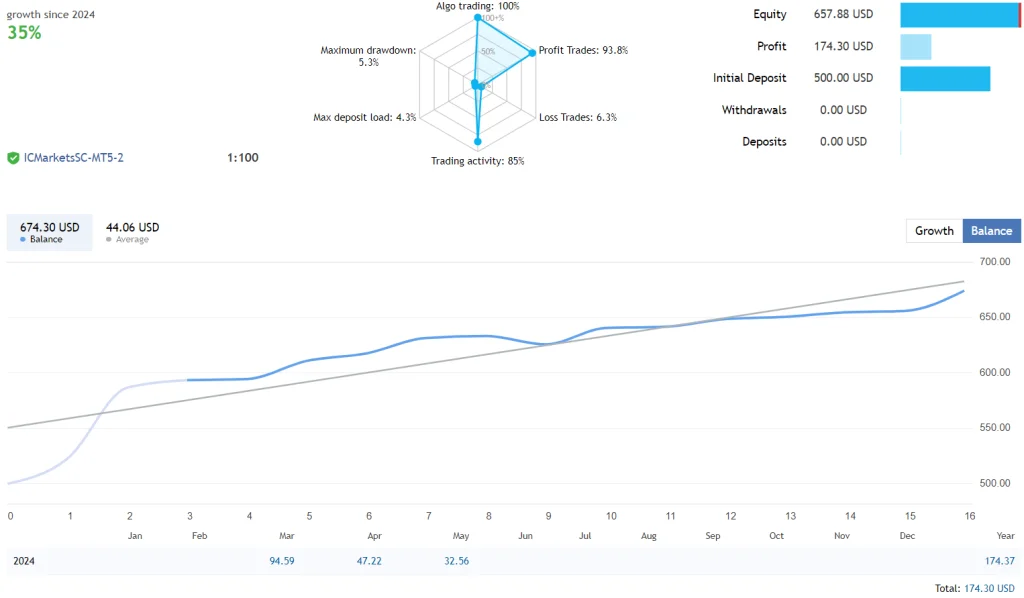

Minimum Account Balance: Start with at least $500 to support the EA’s trading strategy.

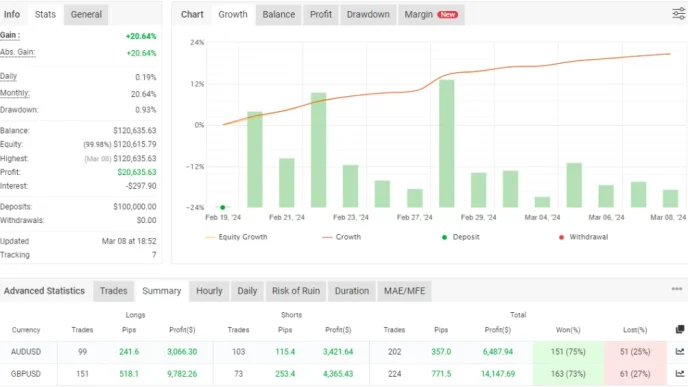

Best Pairs to Trade: TrendMaster FX EA performs optimally on GBPUSD but also shows good results with USDCAD, AUDUSD, EURUSD, and USDCHF.

Optimal Time Frame: Use the M15 time frame. To set up, begin on the weekly time frame to gather data until 30+ candlesticks are visible, then switch back to M15.

Risk Settings: Aggressive traders might set the risk at 0.15, while conservative traders, especially those with larger capital, should start with a risk setting below 0.05 (starting as low as 0.01) to gain familiarity with the EA’s performance.

Recommend running this free forex EA on a VPS (Vultr)

Low Spread ECN account is also recommended Icmarket and Exness