Gold trading is renowned for its high volatility and complexity, requiring precision, adaptability, and exceptional risk management. CyNera EA, marketed as an AI-driven trading solution, claims to leverage cutting-edge strategies and neural network technologies to excel in this challenging market. But does it live up to the hype? Let’s analyze its features, claims, and potential pitfalls.

Seller’s Claims – An AI-Powered Trading Solution

The creators of CyNera MT4 EA boast an advanced trading system that integrates artificial intelligence and neural network technologies to adapt to gold’s unpredictable price movements. Key features include:

- AI-Driven Decision Making

- Employs neural networks, including neuroevolutionary and Echo State Networks (ESN), to predict price trends and refine strategies.

- Transformer Networks

- Analyzes external factors like market sentiment, news, and economic data to influence trading decisions.

- Generative Adversarial Networks (GANs)

- Simulates extreme market conditions to test and enhance strategy robustness.

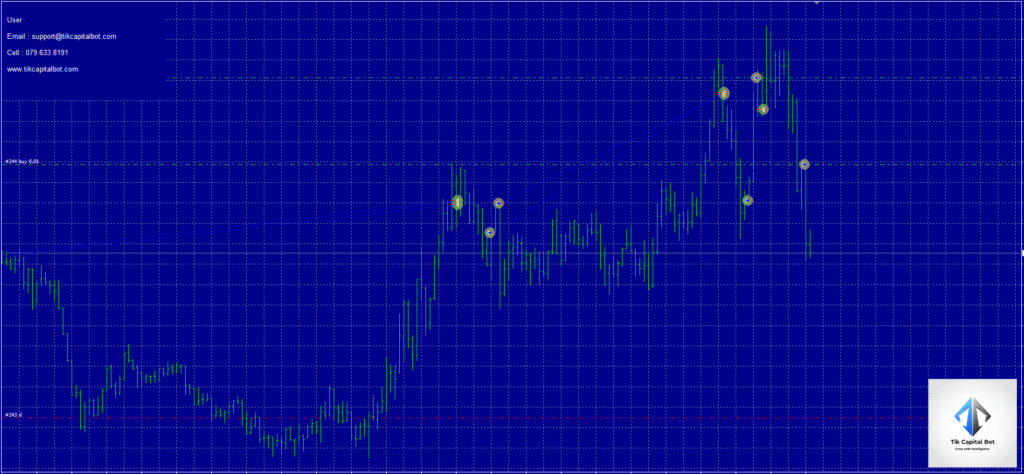

- Dynamic Trading Frequency

- Adjusts trade volume and frequency based on real-time market volatility.

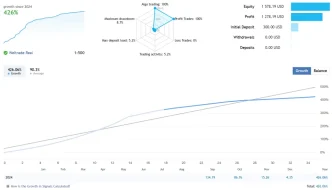

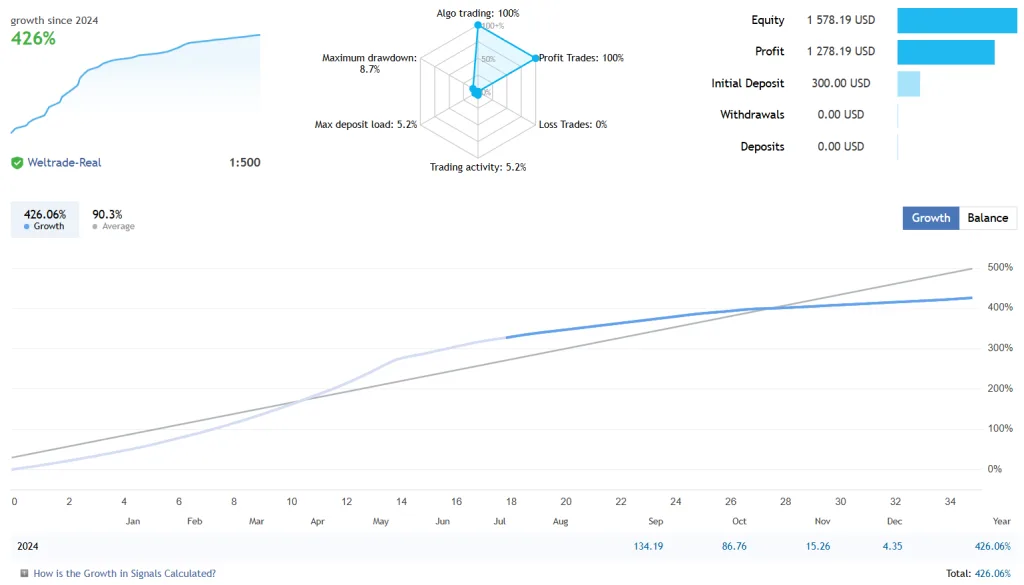

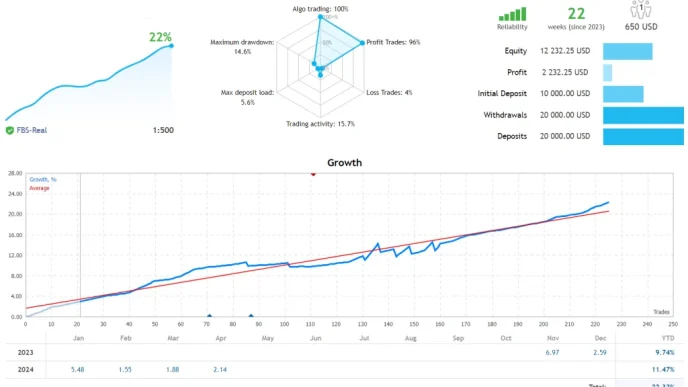

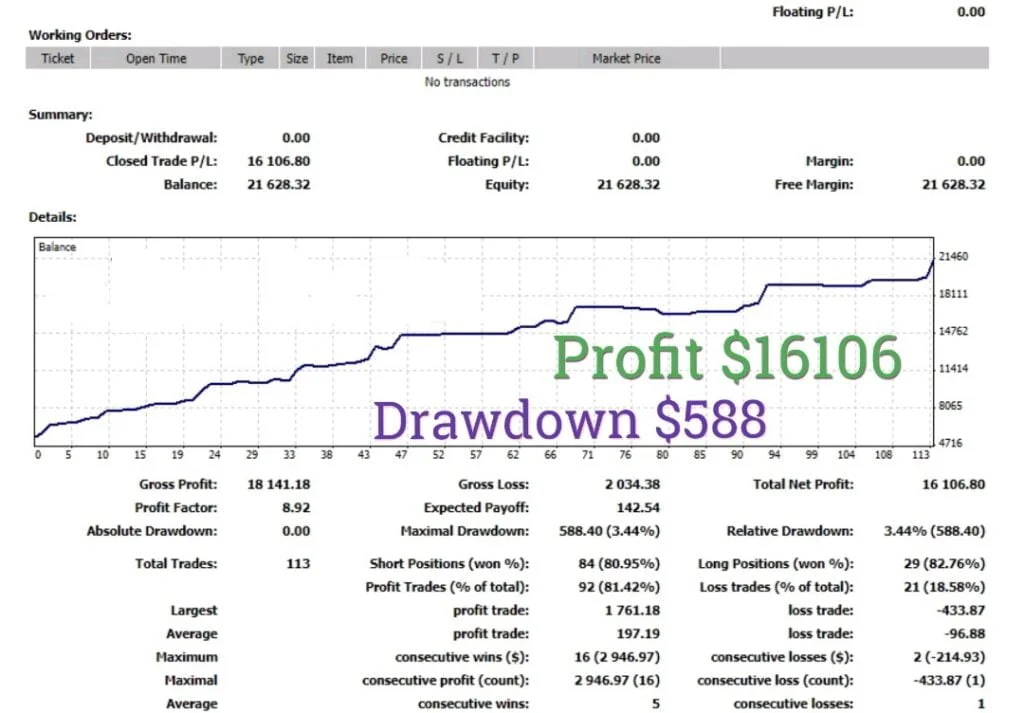

- Proven Performance

- Promises consistent profitability with minimal drawdowns, backed by over a decade of backtesting.

- User-Friendly Design

- Comes with optimized default settings for beginners and customization options for experienced traders.

On paper, CyNera EA appears to be the ultimate tool for gold trading, blending advanced AI and technical innovation with user convenience.

Reality Check – What Lies Beneath the Hype

Despite the impressive claims, experienced traders may find several reasons to approach CyNera EA with caution:

- Opaque Algorithms

- The underlying trading logic is not transparent. Vague phrases like “neural network technologies” replace detailed explanations, leaving potential users in the dark about its true methodology.

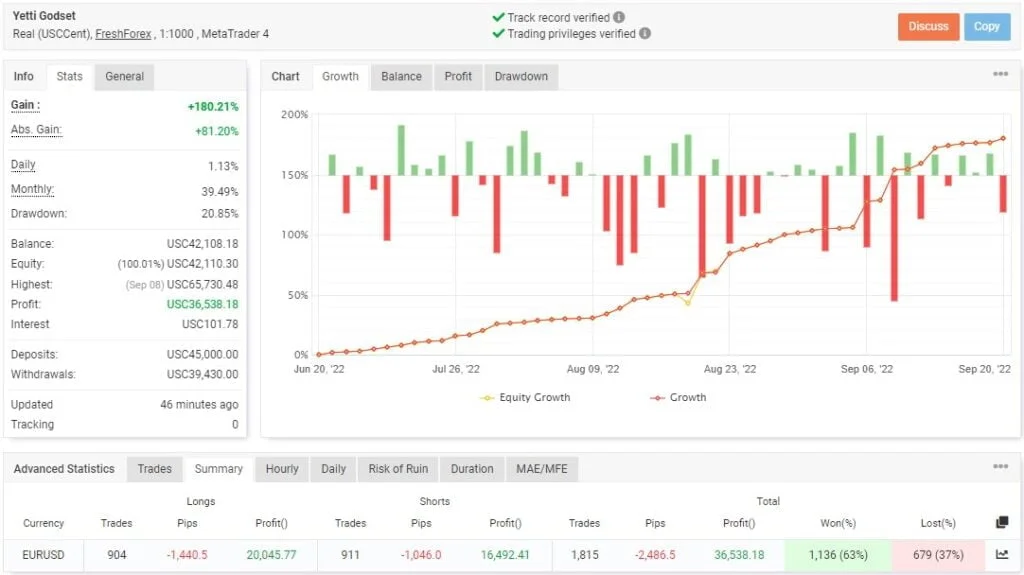

- Unrealistic Backtesting Results

- Backtests often display near-perfect profit curves with negligible drawdowns, which could indicate data manipulation, selective historical data, or optimized settings that may not reflect real-world performance.

- Lack of Meaningful Updates

- Updates often appear to enhance the product but usually add little more than historical data tweaks, creating an illusion of progress without improving functionality.

- Dubious Marketing Tactics

- The EA is heavily marketed to inexperienced traders using complex AI jargon and buzzwords to mask its limitations and appeal to those unfamiliar with trading technologies.

Recommendations for CyNera EA

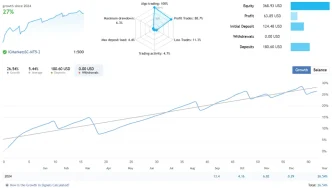

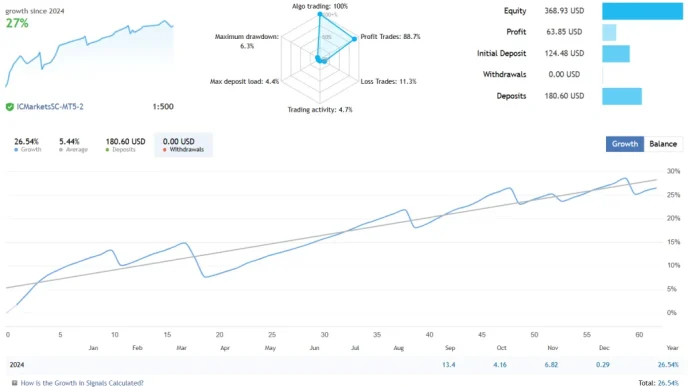

Minimum Account Balance: Start with at least $100 to ensure sufficient margin for gold trading.

Preferred Asset: Works best on GOLD but claims compatibility with other pairs.

Optimal Timeframe: Performs best on the M30 timeframe, though it supports other timeframes.

Recommend running this free forex EA on a VPS (Vultr)

Low Spread ECN account is also recommended Icmarket and Exness