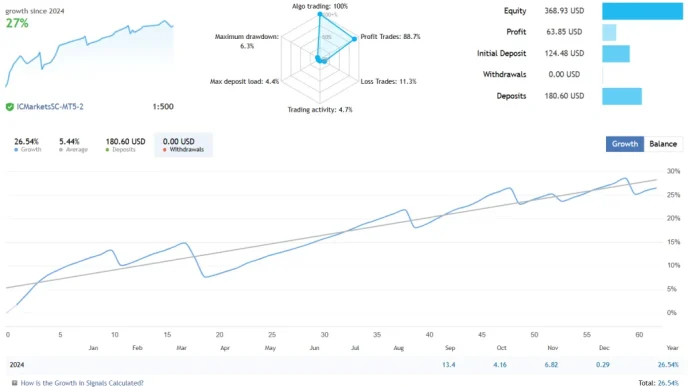

Range Breakout EA is a meticulously crafted Expert Advisor (EA) designed specifically for day traders targeting the European trading session. This EA employs tested trading strategies while avoiding risky methodologies like grid, hedge, or Martingale recovery systems. With a focus on safety and efficiency, Range Breakout EA provides a reliable and disciplined approach to trading.

How Range Breakout EA Operates

Range Breakout EA primarily trades the USDJPY currency pair. Its strategy revolves around a defined range between 1:00 AM and 6:50 AM (GMT/UTC+2). Once this range is established, the EA monitors breakouts and opens a single position in the direction of the prevailing trend.

Key Operational Features:

- Trailing Stop: Once a specified profit threshold is met, an optimized trailing stop activates to secure gains while allowing the trade to capitalize on further market movements.

- Daily Closure: All positions are automatically closed at 7:55 PM, avoiding overnight swap fees and optimizing trading efficiency.

- Trend Filter: An integrated trend filter ensures positions align with the market’s dominant direction, enhancing the probability of success.

Key Features of Range Breakout Day Trader EA

1. Risk Management

- Stop-Loss Protection: Each trade is safeguarded with a stop-loss, and users can set a maximum equity drawdown limit for additional security.

- Single Position Per Day: The EA avoids overtrading by opening only one position daily.

- No High-Risk Strategies: Risky approaches like Grid, Hedge, or Martingale are excluded, maintaining a controlled and safer trading environment.

- Trailing Stop with ATR: Positions are managed dynamically, using ATR values to adjust trailing stops.

- Rollover Avoidance: All trades are closed before the end of the trading day, eliminating rollover fees and associated risks.

2. Notification Alerts

The EA can send alerts via email or notifications when specific profit levels are reached. These alerts allow traders to consider manual intervention for maximizing profits, though this carries additional risks.

3. Prop Firm Ready

Range Breakout EA is optimized for passing prop firm challenges, offering both LOW RISK and EXTRA LOW RISK settings to meet strict drawdown requirements.

Prop Firm Optimization Tips:

- Configure maximum equity drawdown limits below daily drawdown thresholds.

- Avoid trading during high-impact news events, such as interest rate announcements, to reduce slippage and risks.

- Start with EXTRA LOW RISK settings, transitioning to LOW RISK as your account balance grows.

4. Additional Features

- Flexible Lot Sizing: Choose between risk-based lot sizing or a fixed lot size, accommodating different trading styles and account sizes.

- Integrated News Filter: Prevents trades from being placed during high-impact news events, protecting against sudden market volatility.

- Trend Filter: Aligns trades with the market’s prevailing direction to increase success probabilities.

Recommendations for Optimal Performance

Minimum Account Balance: $100

Optimal Currency Pair: USDJPY (can be used with other pairs)

Time Frame: Works best on M5 (compatible with other time frames)

Broker Settings: Default configurations are designed for brokers on GMT/UTC+2 with DST. Adjustments may be needed for brokers with different server times.