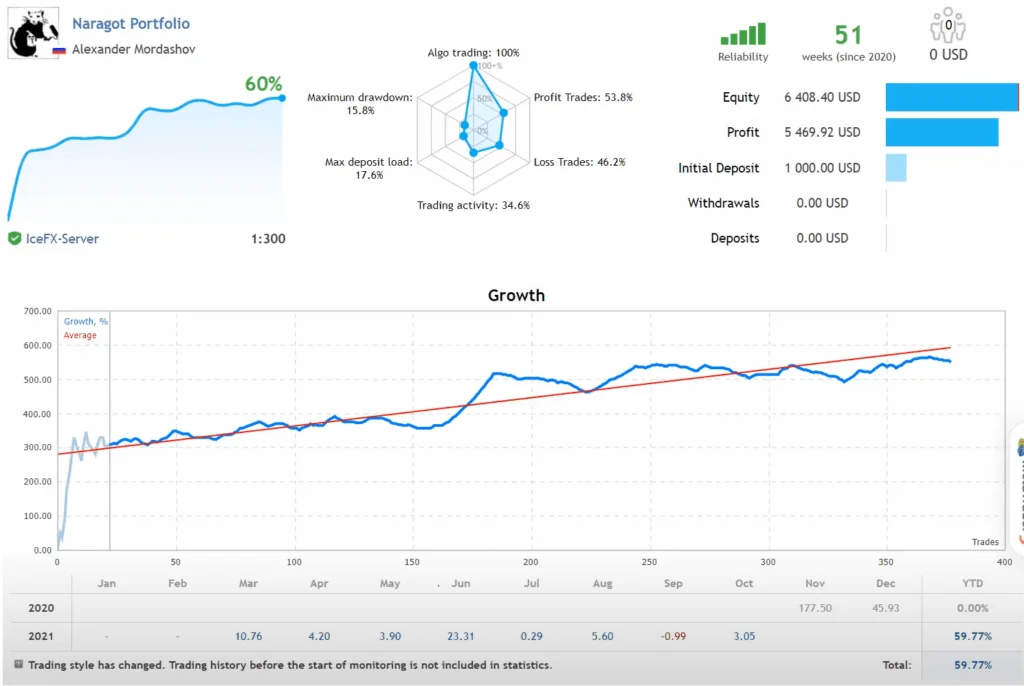

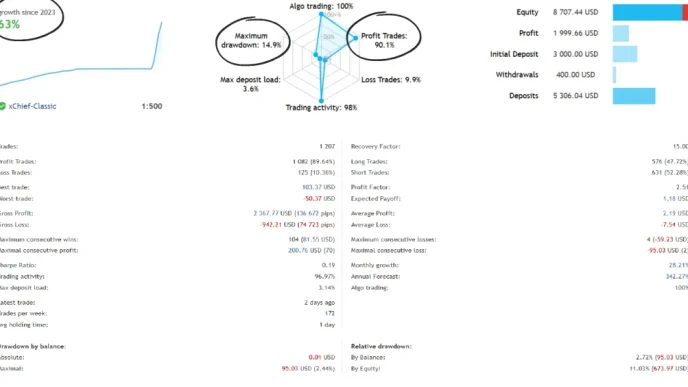

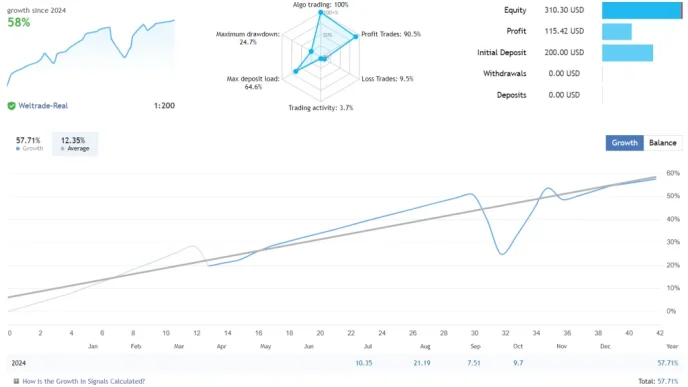

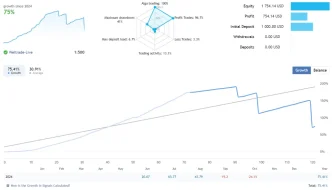

The Naragot Portfolio EA is a fully automated MetaTrader 4 (MT4) multi-currency expert advisor, designed for traders who seek precision and reliability in their trading strategies. This EA is built on the principles of volatility breakouts and support and resistance level breakouts, employing seven carefully selected strategies from a broader pool of proven approaches. Best of all, it’s available free to download.

This article provides a detailed overview of the Naragot Portfolio EA, a tool that has gained the trust of professional forex traders for its effectiveness and disciplined approach to trading.

Unique Approach to Trading

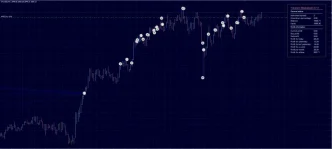

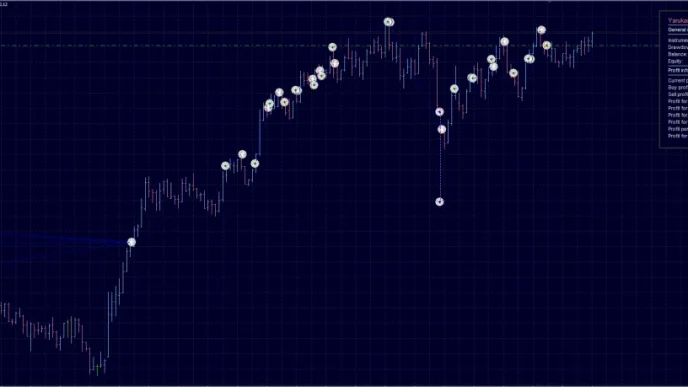

What sets the Naragot Portfolio EA apart is its focus on quality over quantity. Unlike many other systems that promise daily trades or weekly profits, this EA mirrors the approach of professional traders: it seeks rare but highly accurate entries. By capitalizing on significant market trends, the EA ensures it trades only when optimal opportunities arise, allowing it to maximize returns during large trending movements.

Unlike systems relying on over-optimized indicators or curve-fitted strategies, the Naragot Portfolio EA operates on fundamental trading principles that are effective across multiple instruments and market conditions.

Trading Principles of the Naragot Portfolio EA

The EA adheres to the adage “Trend is your friend”, focusing exclusively on trend-following strategies. To enhance its effectiveness, it employs two distinct methods of trend trading, offering broader market coverage.

Key Features:

- Pure Price Action: The EA does not rely on any technical indicators, instead analyzing raw market data for precise trade execution.

- Core Pairs: Targets four of the most liquid forex pairs:

- EURUSD

- GBPUSD

- XAUUSD (Gold)

- USDJPY

These pairs are chosen for their low spreads and high liquidity, which are ideal conditions for trend-following strategies.

Robust Risk Management

The Naragot Portfolio EA places a strong emphasis on protecting capital and ensuring long-term profitability. Every trade is equipped with predefined Take Profit (TP) and Stop Loss (SL) levels, which remain fixed until the trade closes. Key aspects of its risk management include:

- Positive Risk-Reward Ratio: TP levels are always equal to or higher than SL levels, ensuring trades are skewed toward profitability.

- Avoidance of Risky Techniques: The EA does not employ high-risk methods such as:

- Grid trading

- Martingale

- Curve fitting

- Artificially high win rates

This disciplined approach minimizes the risk of account blowouts and enhances the system’s reliability.

Recommendations for Using the Naragot Portfolio EA

Minimum Account Balance: Requires a minimum of $1,000 for optimal performance.

Single-Chart Setup: Attach the EA to a single currency pair (preferably EURUSD), and it will automatically manage trades across all input-defined pairs.

Optimal Timeframe: Best suited for the M1 timeframe.

Recommend running this free forex EA on a VPS (Vultr)

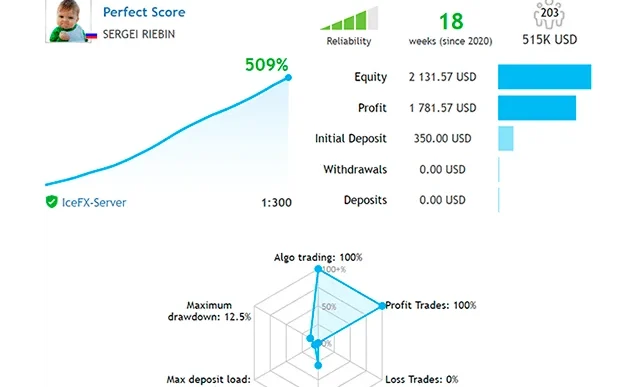

Low Spread ECN account is also recommended Icmarket and Exness