The HFT Robot is a specialized Forex Expert Advisor (EA) created for traders aiming to pass proprietary trading firm (prop firm) challenges. It’s designed to meet the demanding requirements of these challenges, particularly for firms that permit high-frequency trading (HFT). This article explores the unique features and benefits of this EA, highlighting why it’s effective for prop firm evaluations.

Key Features of the HFT Robot

- Purpose-Built for Prop Firm Challenges: Specifically engineered to handle prop firm evaluations, the HFT Robot is tailored to meet the high standards required by these firms. Its primary objective is to help traders pass these challenges successfully.

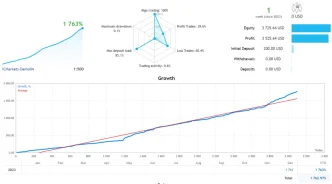

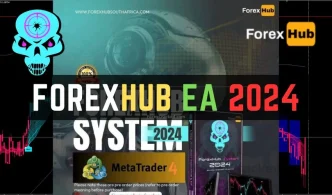

- Rapid Target Achievement with Low Drawdown: The EA is designed to reach challenge targets quickly, often with minimal drawdown, which is essential for meeting the strict requirements of prop trading.

- Advanced HFT Strategy: Using a proprietary HFT strategy, the EA detects and capitalizes on significant market movements, enhancing its efficiency in achieving profitable trades.

- Effective Risk Management: Equipped with a built-in stop-loss feature, this EA helps protect against unexpected market shifts, ensuring that capital is preserved even in volatile conditions.

- Equity Protector: To secure gains, the HFT Robot includes an equity protector that halts trading once the target is achieved, locking in profits and avoiding unnecessary risk.

- Pro-Ratio Money Management (PRMM): The EA features an innovative PRMM system, which automatically adjusts lot sizes based on account gains. This approach enables faster challenge completion while maintaining low drawdown levels. Traders also have the option to enter lot sizes manually for added control.

- Active Market Condition Sensitivity: Operating primarily during peak trading hours, the HFT Robot leverages active market conditions, often completing challenges within an hour.

- Non-Martingale, Non-Grid System: Unlike other EAs, the HFT Robot avoids risky martingale and grid systems. It opens one trade at a time, closing each position before opening a new one, ensuring disciplined risk management.

- Sequential Trade Management: The EA opens and closes one trade at a time, following a structured, disciplined approach with stop-loss protection for each trade. This controlled strategy distinguishes it from high-risk trading systems.

Note: The HFT Robot is designed specifically for prop firm evaluations and challenges that permit HFT. It is not intended for general live accounts or non-HFT prop firm accounts, emphasizing its niche specialization.

Important Requirements and Recommendations

- Optimal Trading Conditions: For best performance, the HFT Robot needs a broker with low spreads, minimal slippage, fast execution, and a low-latency VPS to ensure smooth operation.

- Recommended Instruments: Optimized for trading on indices like US30 (DJ30, WS30) and GER30 (DE30).

- Best Time Frames: Performs most effectively on the M1 or M5 timeframes.

- Recommend running this free forex EA on a VPS (Vultr)

- Low Spread ECN account is also recommended Icmarket and Exness

Supported Prop Firms for HFT

The HFT Robot is tested and intended only for use with specific prop firms that allow HFT trading, including:

- Fast Forex Funding

- Infinity Forex Funds

- Nova Funding

- Next Step Funding

- Quantec Trading Capital

- Kortana Fx

- Social Trading Club

- M Solutions

- MDP Fundings