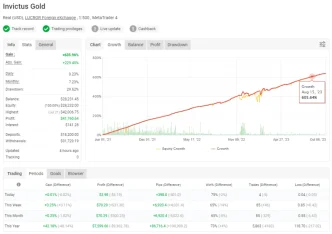

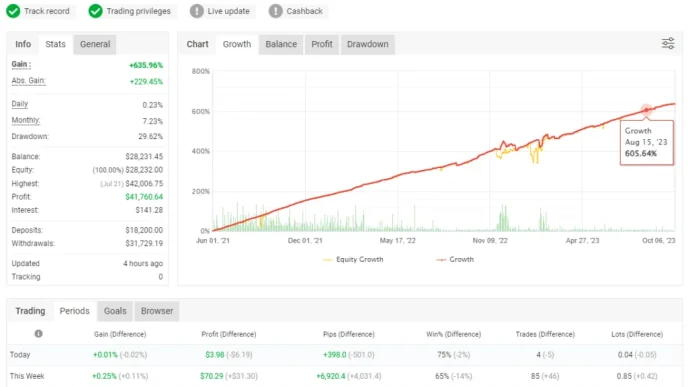

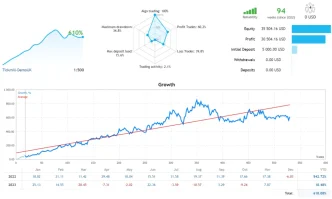

Choppa EA is a fully automated Expert Advisor, available as a free download, that aims to assist traders in achieving profitability through real-time market analysis and automated trades. While the developer makes bold claims, including that automation with Choppa EA can turn around the high failure rate among manual traders, there is limited transparency on how the EA operates. Here, we’ll examine what Choppa EA offers, its focus trading pairs, and insights from independent testing.

The developer describes Choppa EA as a user-friendly trading bot that helps traders succeed where manual trading often fails. They advocate for automation as a pathway to profitability, yet detailed documentation or explanations on the EA’s exact methods are missing. Instead, promotional materials consist primarily of profit screenshots and videos, which have raised some skepticism regarding authenticity.

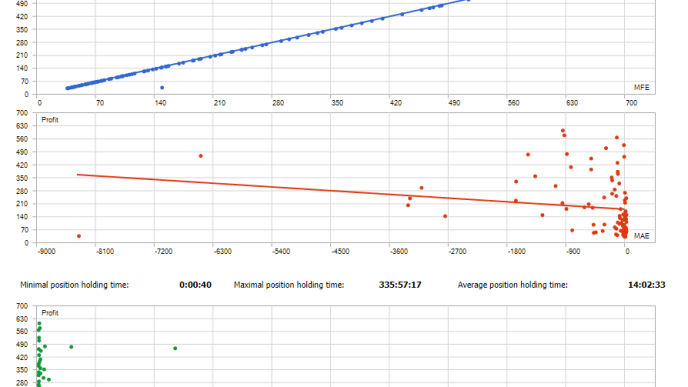

Independent tests reveal some of the functionality behind Choppa EA. The EA appears to rely on the RSI (Relative Strength Index) combined with price action indicators to guide its trades. While its main focus is on US30 and US100 indices, it also occasionally trades in currency pairs like GBPUSD and EURUSD, as well as commodities such as XAUUSD (Gold).

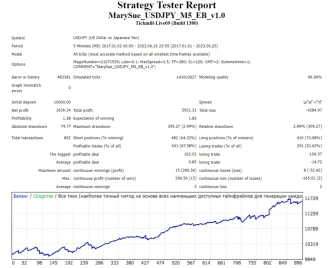

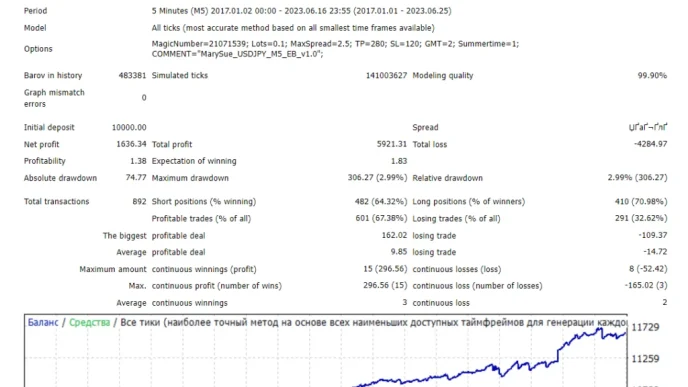

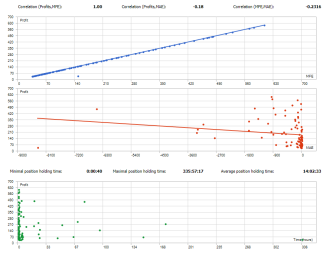

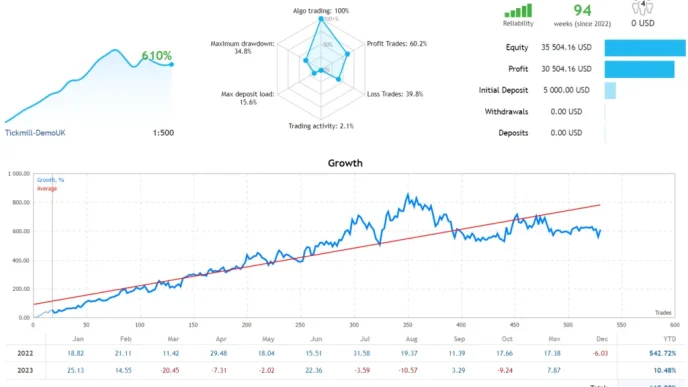

A positive feature of Choppa EA is its avoidance of high-risk trading strategies, such as martingale and grid trading. It also incorporates risk management through preset stop-loss and take-profit levels for every trade. When configured to the recommended M5 timeframe, the EA typically opens 8-12 trades per day, balancing trading activity with risk control.

Recommendations for Using Choppa EA

Minimum Account Balance: $100.

Primary Trading Focus: Best suited for trading indices like US30 (DOW30/DJI) and US100 (USTECH), though it also supports currency pairs (e.g., GBPUSD, EURUSD) and commodities (e.g., XAUUSD Gold).

Trade Frequency by Timeframe: Higher frequency on lower timeframes, with M5 being the recommended timeframe for optimal performance.

Recommend running this free forex EA on a VPS (Vultr)

Low Spread ECN account is also recommended Icmarket and Exness

Broker Recommendations: A low-spread ECN account is recommended for better execution (find suitable brokers here).